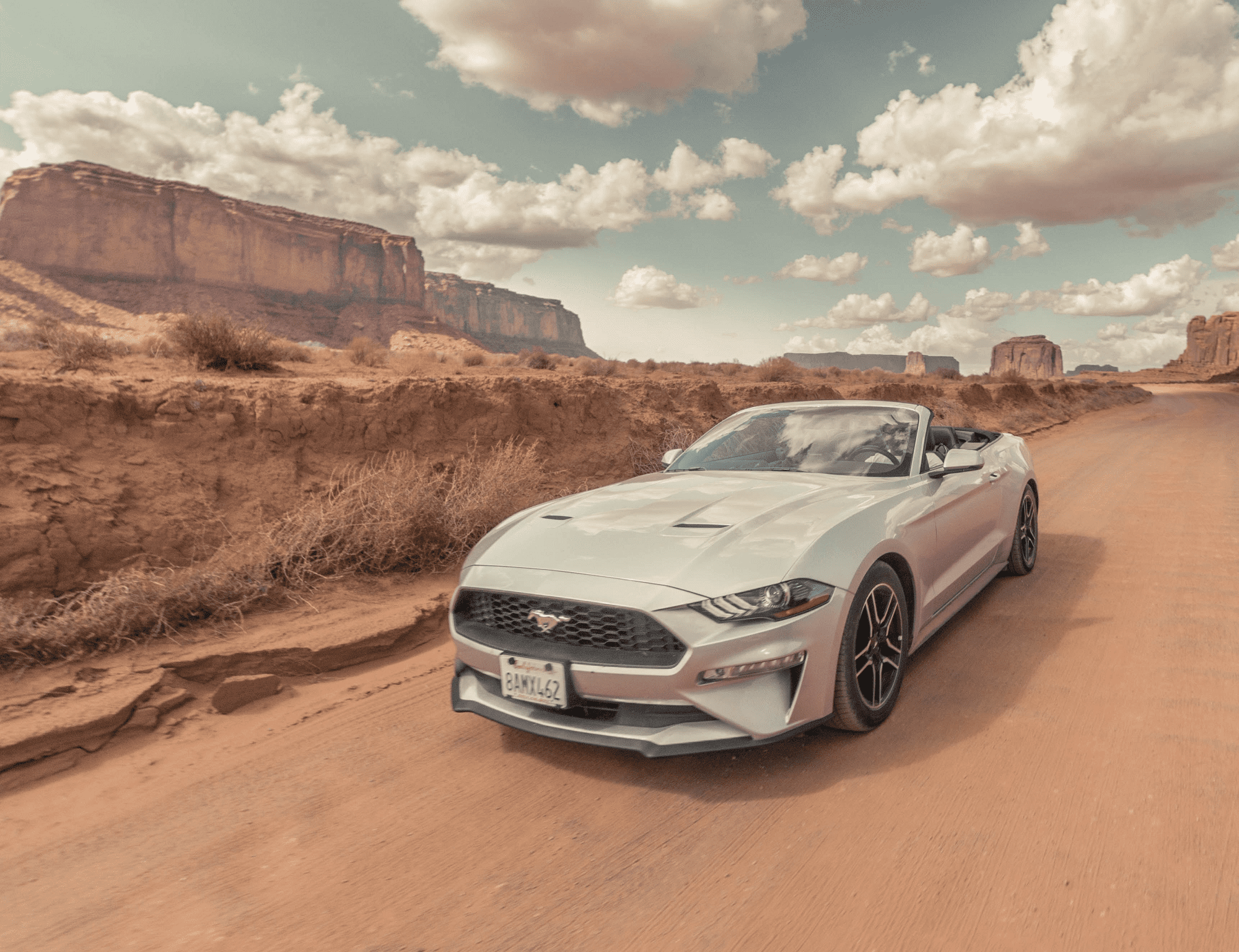

Finding the best temporary Mexican auto insurance is crucial for anyone planning to drive south of the border. Mexico has unique insurance requirements, and without proper coverage, you could find yourself in legal trouble or facing significant financial liabilities in the event of an accident. Here are some key steps to help you find the best temporary Mexican auto insurance:

- Research Mexican Insurance Providers: Start by researching Mexican insurance providers that offer coverage for temporary trips. Look for well-established and reputable companies with a history of serving international travelers. SmartGringo works with Baja Bound, which has been providing Mexican insurance since 1994.

- Compare Coverage Options: Mexican auto insurance policies can vary widely in terms of coverage, limits, and exclusions. Compare the coverage options offered by different providers to ensure they meet your needs. Ensure that your policy includes liability coverage, which is required by Mexican law, as well as coverage for damage to your own vehicle and theft.

- Understand Mexican Insurance Requirements: Familiarize yourself with Mexican insurance requirements, as they differ from those in the United States or Canada. Mexican law requires a minimum amount of liability coverage, so make sure your policy meets or exceeds these requirements. Additionally, be aware that Mexican authorities may not recognize U.S. or Canadian insurance policies, so having a Mexican-specific policy is essential.

- Check Additional Benefits: Consider any additional benefits offered by the insurance provider. Some policies may include roadside assistance, legal assistance, or medical coverage, which can be valuable if you encounter unexpected issues during your trip. These benefits can add value to your insurance policy.

- Obtain Multiple Quotes: To ensure you get the best value for your money, obtain quotes from multiple insurance providers. This allows you to compare prices and coverage options to find the policy that best suits your budget and needs. Be sure to ask about any discounts that may be available, such as multi-trip or multi-vehicle discounts.

- Read the Fine Print: Before purchasing Mexican auto insurance, carefully read the policy terms and conditions. Pay attention to any exclusions or limitations, and make sure you fully understand what is covered and what is not. If you have any questions or concerns, don’t hesitate to ask the insurance provider for clarification.

In conclusion, finding the best temporary Mexican auto insurance requires thorough research and careful consideration of your specific needs. By comparing coverage options, understanding Mexican insurance requirements, and obtaining multiple quotes, you can ensure that you have the right coverage to protect yourself and your vehicle while traveling in Mexico. Taking these steps will provide peace of mind and help you enjoy your Mexican road trip with confidence.